Research

Selected research published by the Burning Glass Institute independently or in partnership with other leading workforce innovation and higher education organizations

Labor Market Outlook August 2024

The U.S. labor market presents a paradox: substantial cooling with unemployment jumping from 3.5% to 4.3% in the last year, alongside robust economic growth and rising employment. This unusual dynamic stems partly from supply-side expansions—a surge in immigration, increased labor force participation, and significant gains in labor productivity—that have outpaced demand growth, creating a looser labor market despite economic strength.

This dynamic adds to other key labor market data to suggest a gradual labor market cooling underway rather than an impending recession. Permanent layoffs remain stable, while most increases in unemployment stem from individuals re-entering the labor market. Wage growth, though decelerating, still outpaces pre-pandemic rates, with slowdowns primarily in highly educated sectors.

However, this trend is precarious. Labor-market indicators are nonetheless moving in the wrong direction, raising the risk of a more rapid and disorderly contraction. Without a change in monetary policy, the probability of a recession will likely continue to rise as the supply-side tailwinds that have propelled the economy begin to wane in coming months.

Labor Market Outlook, April 2024

With inflation rates accelerating beyond the Federal Reserve's 2% target, the possibility of a "soft landing" this year grows dimmer. However, emerging dynamics, including increased immigration and the strategic integration of Generative AI, hint at a promising shift toward stability by 2025. Dive into our latest economic report for a detailed analysis of the current inflation trends, labor market conditions, and the technological advancements shaping our economic future. Discover what these changes mean for businesses, policymakers, and consumers as we explore the potential for sustainable growth amidst evolving economic challenges.

U.S. Labor Market Outlook December 2023

The recent combination of robust economic growth and notable decrease in inflation has fueled optimism for a "soft landing" in 2024, with inflation aligning with the Federal Reserve's 2 percent target without triggering a recession. However, we hold a different view. While a soft landing is more likely now than it seemed even a few months ago, our analysis of labor market dynamics suggests that a more plausible scenario is that inflation will fail to drop down to the 2-percent target in 2024, leading to a 'no landing' scenario.

The rapid expansion of the U.S. labor force in 2023 was driven by temporary factors, such as an influx of immigration and high labor force participation rates, which are unlikely to continue through 2024. With immigration rates slowing down and labor force participation rates already at peak levels with limited potential for further increase, we can expect a significant slowdown in labor force growth in the year ahead. This shift could stabilize or even reverse the recent rise in unemployment rates.

This is significant because this expansion in the workforce has been a major factor in loosening the labor market over the past several months. However, as workforce growth slows, the labor market will remain tight, leading to sustained upward pressure on wages and, consequently, inflation. In such a scenario, it seems likely that the inflation rate will stay above 2 percent in 2024 – what we refer to as “no landing”.

U.S. Labor Market Outlook July 2023

Despite persistent recession fears and aggressive tightening measures by the Fed over the past year, the US economy has proven to be resilient. American consumers, dipping into the savings they accrued during the pandemic, keep increasing their spending. Recent economic indicators even suggest an upward trend in the economy.

In the first half of 2023, overall job growth remained strong. The primary reason for this positive trend, particularly in job growth, is the robust recovery of in-person service industries such as restaurants, hotels, entertainment, and healthcare, as well as in government. While job growth in these sectors is slowing down, it is projected to remain higher than normal for the rest of 2023.

Not all is rosy. Consistent with their sectoral composition, the jobs being created through this boom have largely been lower-wage service jobs. What’s more, another factor contributing to the rapid job growth and tightened labor market is sluggish productivity growth. With productivity stagnant, any economic growth has to translate directly to a growing demand for labor.

U.S. Labor Market Outlook March 2023

This is what happens when an unstoppable force meets an immovable object.

In the March 2023 edition of the Burning Glass Institute Labor Market Outlook, we will provide an outlook for the US economy and labor market before focusing in on the pandemic’s main long-term impact.

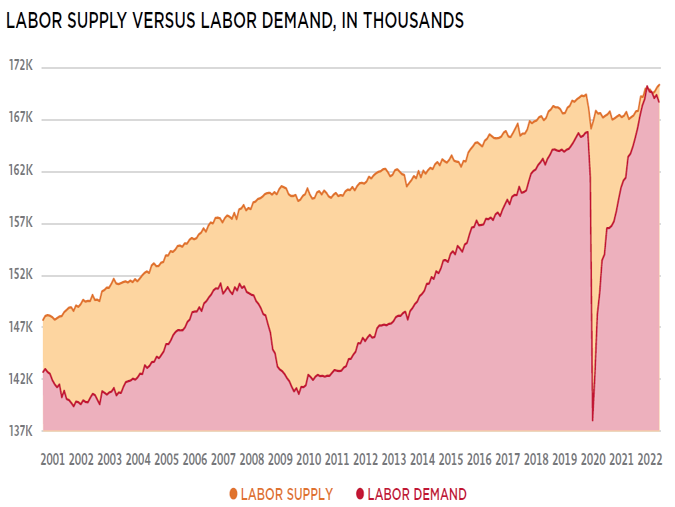

2022 taught us that the demand for US workers was more unstoppable and the labor supply more immovable than we had expected. That is, on the one hand, demand for talent remained strong despite rapidly rising wages while, on the other, the lure of high pay and greater flexibility in work did little to draw workers back to the market. The result is a labor market that has remained tight, driving further upward wage and inflation pressure.

U.S. Labor Market Outlook November 2022

Propped up by strong consumer spending on services, healthy business spending on R&D, and the continued recovery of key sectors adjusting to a new normal, the U.S. economy has managed to skirt recession thus far.

But recession isn’t far off. Continued tightness in the labor market will be a key driver of inflation, forcing the Fed to keep raising rates to lower demand for labor.

Even during a recession, labor shortages would linger, particularly in low- and middle-skill occupations where low rates of workforce participation, an aging workforce, and misalignment in the educational contours of the workforce will continue to challenge supply chains.

Labor shortages are not a temporary problem but a persistent challenge that will significantly limit economic growth for the rest of the decade.

Businesses can take reasonable steps to offset the impact of the ongoing labor shortage and to better weather the storm, while policymakers could return the economy to a growth footing through a series of reforms—but only if they can muster unwonted bipartisan resolve to address thorny issues.

The Through-the-Looking-Glass Recovery

New, complex dynamics in the U.S. Economy suggest that employment in some industries won’t come back from the pandemic.

New, complex dynamics in the U.S. Economy suggest that employment in some industries won’t come back from the pandemic.

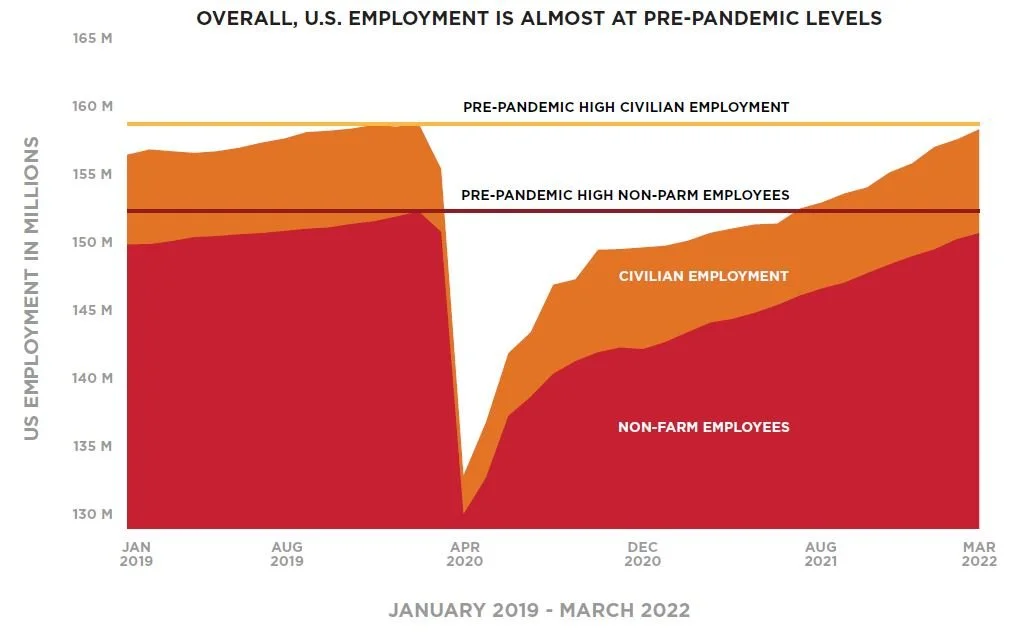

A permanent shake-up of U.S. industries is underway. While the economy sustained massive, near-instantaneous employment loss in the early days of the pandemic, the job market has now returned to 99% of is prior strength after just two years, far faster than the job market recovered from past shocks. But the economy we have returned to usn’t the same as the one we left behind…